Connecticut Avenue Securities (CAS) and Credit Insurance Risk Transfer (CIRT) November 2018 Monthly Reporting

Fannie Mae released its monthly Connecticut Avenue Securities® (CAS) remittance data and Credit Insurance Risk Transfer™ (CIRT™) servicing report today on loan performance during the month of September 2018. The release shows that the number and balance of loans reported as 30-days delinquent increased relative to last month's remittance report, which reflected August 2018 activity.1 We frequently caution investors that the level of 30-day delinquencies can be volatile and not predictive of ultimate default; instead, we view the level of 60-day delinquencies as a better early performance indicator. The 60-day delinquency rate did not exhibit an increase of similar magnitude in this month's remittance data. This commentary provides additional insight into the 30-day delinquency trends reported in this month's data.

Seasonality and the "Sunday Effect"

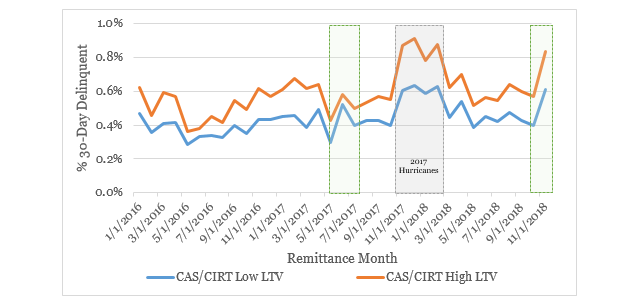

We previously observed a similar increase in 30-day delinquencies in the June 2017 remittance data (see Exhibit 1 below). After that increase, the aggregate rate of 30-day delinquencies declined in the following month. At the time, we published a commentary with insights into delinquencies that cited seasonality and the "Sunday effect" as factors that may have been responsible for this temporary bump. Historically, the month of September has also been characterized by an increase in 30-day delinquencies, likely related to a lower day count and back-to-school expenditures. In addition, months that end on a Sunday generally experience an uptick in delinquencies, as servicers may not receive or apply payments sent at the very end of the month until the following week. We believe that these two factors were the largest contributors to the observed uptick given that September 30 fell on a Sunday this year.

Exhibit 1. 30-Days Delinquent as a Percentage of Unpaid Principal Balance (UPB)

Below, we focus on three additional factors that had an impact on this month's remittance data: (1) significant volumes of servicing transfers; (2) the impact of Hurricane Florence; and (3) one seller-servicer's transition to a new servicing platform.

Impact of Servicing Transfers

Fannie Mae provides a Servicing Activity Indicator field in its monthly remittance data to identify loans that experienced a change in servicing activity during the corresponding reporting period. Servicing transfers occasionally result in an increase in reported 30-day delinquencies. This can result from delays or other timing issues with the borrower's receipt of notifications from the new servicer and/or completion of the operational process of transferring payment collection activities, even if the borrower submits the monthly payment on time. For more detail, please refer to the servicing transfer disclosure commentary.

Although the share of loans that was reported as having experienced a servicing transfer in this month's remittance data was not abnormally high, the 30-day delinquency rate for this population was higher than average at 4.60 percent. Excluding the loans that experienced a servicing transfer would have reduced the aggregate level of 30-day delinquencies by 0.05 percent to 0.64 percent (see Exhibit 2 below).

Impact of Hurricane Florence

In early September, homeowners in the Southeast were impacted by Hurricane Florence. As discussed in our commentary, Fannie Mae provided investors with additional transparency by reporting deal exposure to counties designated by the Federal Emergency Management Agency (FEMA) for its Individual Assistance program on Data Dynamics. As expected, the rate of 30-day delinquencies in these counties – concentrated entirely in North Carolina and South Carolina – increased by more than the rest of the country, rising 0.42 percent to 0.89 percent in the November remittance data. Excluding the loans that are located in FEMA-designated counties would have reduced the aggregate level of 30-day delinquencies by another 1 basis point (see Exhibit 2 below). We remind investors that 30-day delinquencies peaked in the month after the 2017 hurricanes hit. If Hurricane Florence delinquencies follow a similar pattern, we may expect the 30-day delinquency rate to increase further in hurricane-affected areas next month. However, given that CAS exposure to Hurricane Florence was significantly lower than to Hurricanes Harvey and Irma, we anticipate a lower impact on aggregate delinquencies.

Transition to New Servicing Platform

In this month's remittance data, we observed an increase in reported 30-day delinquencies by one seller-servicer that transitioned to a new servicing platform. As noted in our commentary, such situations would not be identified by the servicing activity indicator. We confirmed with the seller-servicer that this jump resulted from a reporting error and was followed by a retracement in October 2018 activity. Excluding this seller-servicer from the rest of the data would have resulted in a 0.01 percent reduction in aggregate 30-day delinquencies (see Exhibit 2 below). However, this seller-servicer's reported performance had a disproportionate impact on Michigan loans; the rate of 30-day delinquencies in Michigan would have increased by only 0.21 percent to 0.73 percent if this seller-servicer were excluded from delinquency calculations.

Exhibit 2. Disaggregation of 30-Day Delinquency Rate Drivers

| Base | Excl. Servicing Transfer | Excl. Hurricane Florence | Excl. Seller-Servicer Behavior | |

|---|---|---|---|---|

| August 2018 | 0.46% | 0.44% | 0.44% | 0.44% |

| September 2018 | 0.69% | 0.64% | 0.63% | 0.62% |

Adjusting for the impacts of servicing transfers, Hurricane Florence, and one seller-servicer's transition to a new servicing platform lowers the aggregate level of 30-day delinquencies by 0.07 percent to 0.62 percent. We believe that this elevated level is likely attributed to seasonality and the "Sunday effect" phenomenon and will look for greater clarity in next month's remittance data. Please contact the Fannie Mae Investor Help Line at 1-800-2FANNIE or by e-mail with any questions.

1 Fannie Mae determines the delinquency status for a given remittance date as of the close of business on the last day of the related activity period. For example, the activity period for the November 2018 remittance date is September 2018, and determinations of loan delinquency status are made as of September 30.

This commentary is provided by Fannie Mae solely for informational purposes based on information available at the time it is published. This document is based upon information and assumptions (including financial, statistical or historical data and computations based upon such data) that we consider reliable and reasonable, but we do not represent that such information, assumptions, data, or computations are accurate or complete, or appropriate or useful in any particular context, including the context of any investment decision, and it should not be relied upon as such. It is subject to change without notice. Fannie Mae disclaims any responsibility for updating the commentary or the opinions or information discussed herein. The opinions presented in the commentary represent the views of professionals employed by Fannie Mae of certain factors that may impact the performance of certain loans in Connecticut Avenue Securities reference pools. The effect of factors other than those assumed, including factors not mentioned, considered or foreseen, by themselves or in conjunction with other factors, could produce dramatically different performance or results. Statements in this commentary regarding the future impact of data quality improvements are forward-looking, and actual results may be materially different due to, among other reasons, those described in "risk factors" in our most recent Form 10-K and Form 10-Q. Fannie Mae does not represent that such views are the sole or most accurate explanations for loan performance or that there are not credible alternative views or opinions. Fannie Mae publishes this commentary as a service to interested parties and disclaims any liability for any errors contained herein. Fannie Mae securities are more fully described in applicable offering circulars, prospectuses, or supplements thereto (such applicable offering circulars, prospectuses and supplements, the "Offering Documentation"), which discuss certain investment risks and contain a more complete description of such securities. All statements made herein are qualified in their entirety by reference to the Offering Documentation. An offering only may be made through delivery of the Offering Documentation. Investors considering purchasing a Fannie Mae security should consult their own financial and legal advisors for information about such security, the risks and investment considerations arising from an investment in such security, the appropriate tools to analyze such investment, and the suitability of such investment in each investor’s particular circumstances.