In Response to the Magnitude of Hurricane Harvey, Fannie Mae Will Make Updates to its CAS 'Fixed Severity Loss' Program

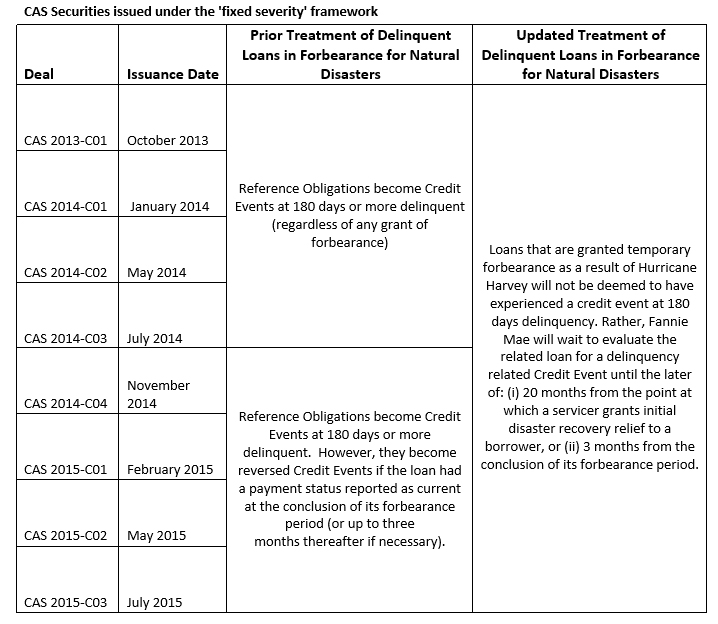

We are committed to supporting our customers and homeowners impacted by Hurricane Harvey, and providing transparency to our investor partners who share in the credit risk of our single-family book of business. With this announcement and as a result of the impact of Hurricane Harvey, Fannie Mae is updating its treatment of loans with disaster-related forbearance for Connecticut Avenue Securities™ (CAS) transactions issued under the 'fixed severity' framework (those deals from CAS 2013-C01 through and including CAS 2015-C03).

Fannie Mae’s guidelines for single-family mortgages allow servicers to grant an initial period of forbearance to any borrower they believe has been affected by a natural disaster. Due to the magnitude of Hurricane Harvey, we expect to see an increase in the number of borrowers being offered disaster-related forbearance in the areas affected by this powerful storm. Under the CAS fixed severity framework, a loan that becomes 180-days or more delinquent is treated as a credit event regardless of any grant of forbearance. With this update, loans that are granted temporary forbearance as a result of Hurricane Harvey will not be deemed to have experienced a credit event at 180 days delinquency. Rather, Fannie Mae is announcing that it will wait until the later of 20 months from the point at which a servicer grants initial disaster recovery relief to a borrower or three months from the conclusion of its forbearance period due to Hurricane Harvey to evaluate the related loan for a delinquency related Credit Event.

The treatment of all other events defined as credit events under the CAS fixed severity framework will remain unchanged:

- a short sale is settled,

- the related Mortgage Note is sold to a third party during the foreclosure process,

- a deed in lieu of foreclosure is executed, or

- an REO acquisition occurs.

CAS offerings beginning with CAS 2015-C04, issued under the ‘actual loss’ framework, are not impacted by the update described above and will remain subject to the timing and loss calculations as described in such offerings.

Please note that a temporary forbearance period offered as a result of a natural disaster is in no way related to principal forbearance that might be granted as part of a loan modification in which a portion of the principal balance due becomes non-interest bearing. Natural disaster forbearance will not have an impact on amounts due under our modification event provisions.

Why is Fannie Mae making this update?

Fannie Mae changed its treatment for loans with temporary forbearance in fixed severity CAS deals beginning in late 2014 to reflect the temporary nature of the forbearance and to better align the treatment of credit events with the ultimate outcome of the loan following the forbearance period. Fixed severity CAS offerings beginning with 2014-C04 through and including 2015-C03 included a provision whereby a credit event is reversed for a loan that becomes 180-days delinquent while in forbearance, if that loan becomes current within 90 days following the end of the forbearance period. Given the unprecedented nature of events associated with Hurricane Harvey, as a benefit to our CAS investors, we are updating our practices to reflect consistent treatment across all fixed severity CAS transactions.

Fannie Mae reserves the right to evaluate each situation independently. The update described in this announcement regarding the timing of recognition of credit events for the referenced CAS transactions applies only to loans impacted by Hurricane Harvey and does not mean that similar actions will be taken in the event of future natural disasters.

Market participants may contact the Fannie Mae Investor Help Line at 1-800-2FANNIE, Option 2, or by e-mail with questions.