A Refresher on Fannie Mae’s High Loan-to-Value Refinance Option

In August of 2017 and at the direction of its regulator and conservator the Federal Housing Finance Agency (FHFA), Fannie Mae announced its high loan-to-value (LTV) refinance option. The high LTV refinance option is applicable to mortgage loans owned by Fannie Mae that are originated on or after October 1, 2017. Because these loans will begin to be referenced in credit risk sharing transactions, Fannie Mae is making prospective changes to its Connecticut Avenue Securities™ (CAS) deals, beginning with its 2018-C02 deal, and to its CIRT transactions, beginning with CIRT FE 2018-1, to accommodate the new high LTV refinance option. With this change taking effect, mortgage loans that are covered in Fannie Mae's CRT programs and that are refinances under the high LTV refinance option will continue to maintain coverage in the respective CRT transaction. This "continuance of coverage" model does not apply to CRT transactions prior to CAS 2018-C02 and CIRT FE 2018-1.

The continuance of coverage approach

When a borrower refinances under the high LTV refinance option, the new loan represents existing credit risk, i.e., the same borrower and property that may already be covered in an outstanding CRT deal. However, the borrower benefits from a reduced monthly payment, lower interest rate, shorter amortization term, or more stable mortgage product. Because these loans represent a replacement of existing risk, the continuance of coverage approach for future CRT deals provides for this risk to remain with existing CRT investors. Rather than be treated as a prepayment, a loan refinanced under this option will remain in the respective CRT transaction. The refinanced loan will reflect, if applicable, a revised unpaid principal balance, a revised term, and a revised interest rate. From a CAS transaction perspective, interest rate reductions will not impact CAS investors.

Fannie Mae's high LTV refinance option

The option provides limited cash-out refinance opportunities to borrowers with existing Fannie Mae mortgages who are making their mortgage payments on time, but whose LTV ratio for a new mortgage exceeds 95% for a one-unit principal residence or exceeds the maximum allowable LTV ratio for a limited cash-out refinance for other segments as listed in the Eligibility Matrix1. To be eligible for the option at least 15 months have passed from the Note Date of the loan being refinanced to the Note Date of the new loan for the loan.

The goal of this refinance option is to have in place a proactive approach that can be used by borrowers who are current on their mortgages during an economic environment in which the borrowers have experienced both a decline in the value of their home and, as with the Home Affordable Refinance Program® (HARP®), the borrower receives one or more of the following benefits as part of the refinance:

- Reduced monthly payment

- Lower interest rate

- Shorter amortization term

- More stable mortgage product, such as moving from an adjustable-rate mortgage to a fixed-rate mortgage

This option differs from HARP, in part, since borrowers may use the high LTV refinance option without limit as long as all other requirements, including seasoning and payment history, are met.

Analysis and Insights from the HARP Performance Dataset

In August of 2017, Fannie Mae released a commentary that summarizes the high LTV refinance option as well as the dataset available to support analysis of the program. Market participants are encouraged to view the full commentary here.

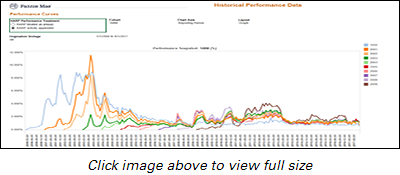

Fannie Mae also recently enhanced its Data Dynamics® tool to provide performance curves within the Historical Performance Data Dashboard, including for its HARP Enhanced Analysis. Previously, market participants were able to view only a snapshot of the most recent performance data available. With this enhancement, users can now observe the performance of historical origination vintages at every point in time since the acquisition of the loan.

We aim to continue to provide transparency and insights into Fannie Mae's fixed income products and programs. We value your feedback and welcome you to reach out to the Fannie Mae Investor Help Line at 1-800-232-6643 or by e-mail with questions.

Related Links

- Summary Analysis and Insights from the HARP Performance Data Addendum to Fannie Mae's Historical Single-Family Loan Performance Dataset

- High LTV Refinance Lender Letter , which describes the requirements of the existing loan being refinanced and the new loan that will be originated under the high LTV refinance option

- High-level comparison of the High LTV Refinance Option to Fannie Mae's DU Refi Plus™ and Refi Plus™, including HARP

- Analytical and Data Tools

- High LTV Refinance Eligibility Timeline

1 See Fannie Mae's Eligibility Matrix

Home Affordable Refinance Program®, HARP® and the HARP logo are federally registered trademarks of the Federal Housing Finance Agency.