Fannie Mae updates Data Dynamics with Forbearance Data

Introduction

Fannie Mae continues to work with servicers to assist borrowers impacted by the 2017 hurricane events, including assisting borrowers in entering into forbearance plans to provide temporary payment relief for those potentially impacted by the disasters. We also remain committed to providing transparency to our investor partners. Data Dynamics®, our unique analytical tool, has been enhanced to provide additional data related to forbearance for Fannie Mae’s Connecticut Avenue Securities™ (CAS) and Credit Insurance Risk Transfer™ (CIRT™) programs.

What's new in Data Dynamics?

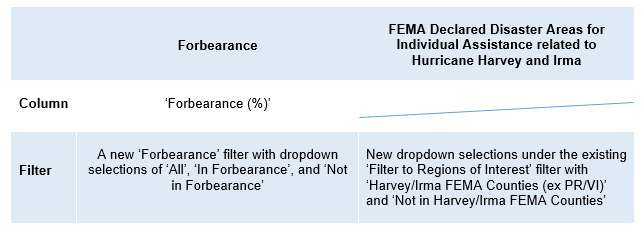

We have enhanced the Data Dynamics dataset to provide deal-level data for both CAS and CIRT with the following:

Forbearance

This column and view is defined as the percentage of unpaid principal balance (UPB) of loans that are 30 days or more delinquent and that servicers have reported are in forbearance. The forbearance data includes loans in forbearance as a result of disaster or for other reasons. When a loan goes into forbearance, it continues to roll into various stages of delinquency.

A forbearance plan may be offered when a borrower experiences temporary hardship, as stated in our Servicing Guide, such as a natural disaster, the death of a borrower or co-borrower, etc. Generally, borrowers eligible for forbearance must be able to bring the mortgage loan current, meet payment terms of a short-term workout option (a repayment plan), or enter into a loan modification.

This new view enables investors to evaluate the percentage of loans in forbearance, as currently known and reported by loan servicers to Fannie Mae, versus loans in various stages of delinquency for other reasons. By combining this flag with the CAS and CIRT Geographic profiles, also available in Data Dynamics, a user can evaluate delinquent loans in forbearance through a number of geographic views.

FEMA Declared Disaster Areas for Individual Assistance

We have added a new view labeled 'Harvey/Irma FEMA Counties (ex PR/VI)', which is defined as the percentage of unpaid principal balance (UPB) where the underlying properties are in FEMA declared disaster areas for individual assistance related to Hurricanes Harvey and Irma (excluding Puerto Rico and US Virgin Islands). To view state-specific CAS or CIRT percentages of UPB exposure in Puerto Rico and US Virgin Islands, Data Dynamics users can access the Geographic Profile report and filter by State or identify the column labeled 'Only PR/VI (%)'.

This new view represents a broader population of loans than is available in the existing 'Harvey/Irma Damage UPB (%)' view. FEMA declared disaster areas for individual assistance are generally broader than the actual storm impact areas and are generated relative to the need for assistance (e.g., evacuation and other types of assistance). FEMA describes the disaster declaration process on its webpages.

This existing 'Harvey/Irma Damage UPB (%)' view (which is a combination of two previously labeled columns called 'Potential Harvey (%)' and 'Potential Irma ex. PR/VI (%)') has not changed but has been combined. This view helps to identify properties that are considered to be in the potential damaged zone as a result of the hurricanes and takes into consideration publicly available data that is more related to damage. We describe the methodology here.

Analyzing Forbearance

The Servicing Guide defines a disaster as an event caused by earthquake, flood, hurricane, or other catastrophe caused by a person or event beyond the borrower's control resulting in devastation in terms of property damage and destruction. Servicers must grant disaster relief when:

- the servicer is unable to contact a borrower who may have been impacted by a catastrophe that was caused by nature or a person other than the borrower; and

- the servicer has determined that such an event may adversely affect either

- the value or habitability of a property securing a mortgage loan, or

- the borrower's ability to make further payments or payment in full on a mortgage loan.

After the servicer's review of the facts and circumstances indicates that the property, the borrower's employment, or the borrower's income is seriously affected by the disaster event, the servicer is authorized to offer a forbearance plan, and must report the loan as being in forbearance. The length of the forbearance plan is based on whether the servicer has achieved quality right party contact with the borrower, as well as the delinquency status of the loan prior to the disaster as described in our Disaster Relief Frequently Asked Questions.

- If the servicer achieved quality right party contact, then the servicer is authorized to offer an initial forbearance plan up to 6 months.

- If the servicer did not achieve quality right party contact, then the servicer is authorized to grant an initial forbearance plan up to 3 months.

We generally observe an increase in loans in early stages of delinquency in the early months after a natural disaster that are not yet identified as being in a forbearance plan.

During a disaster relief and/or forbearance plan period, the CAS remittance data will continue to reflect the actual last paid installment (LPI) date on the loan.

Where do I find this information?

This updated information is available in Data Dynamics under the following description:

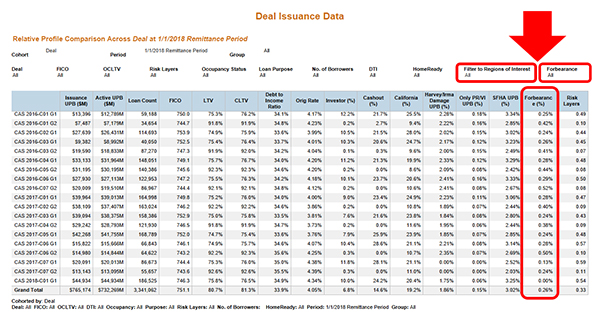

Below is a sample screenshot of Data Dynamics with the new information highlighted in a Deal Issuance and Performance Data report for CAS (click image to view full size):

To sign up to have news and commentary delivered to your inbox related to our Single-Family CRT programs, register here. For additional information, or if you have questions, please contact Fixed Income Marketing at 1-800-2FANNIE or by email.