Announcement

Fannie Mae enhances Data Dynamics

April 20, 2017

As part of our continuing effort to increase transparency for investors, Fannie Mae has recently enhanced Data Dynamics™, our credit risk-sharing data analytics web tool with two new features:

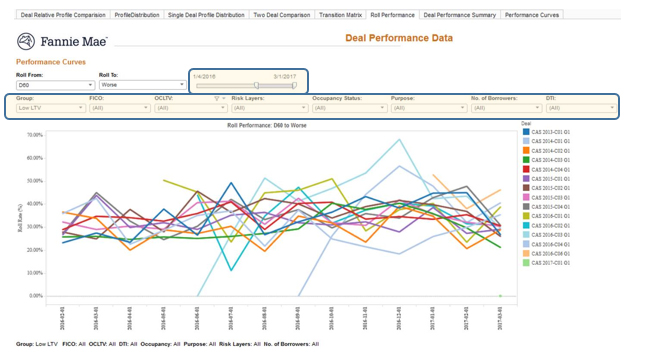

- Roll Performance: This new tab allows users to further analyze delinquency roll rates for our outstanding Connecticut Avenue Securities™ (CAS) deals and is available within the Deal Issuance and Performance Data module. The Roll Performance feature enables the user to filter the data by date, deal group, FICO, Original Combined Loan-to-Value (OCLTV) ratio, Risk Layers, Occupancy Status, Loan Purpose, Number of Borrowers, and Debt-to-Income (DTI) ratio. Users can alter the numerator and denominator of the roll rate from current to various combinations up to over 180 days delinquent (which is labeled as D180+) or to any terminal status.

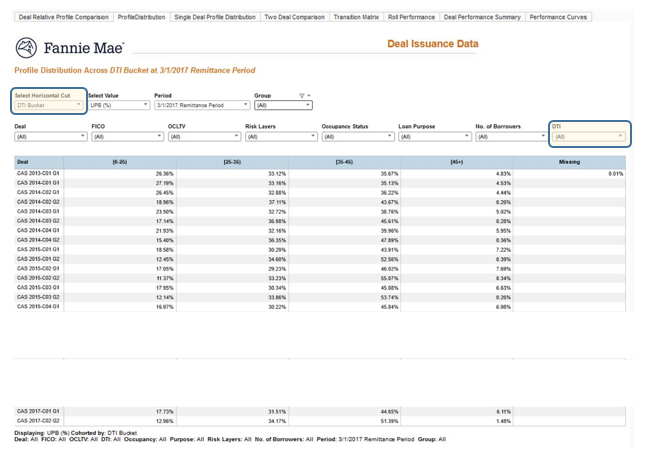

- DTI Filter: This new feature allows users to filter the dataset by various DTI cohorts, including all, 0-25, 25-35, 35-45+, and missing. It is available on the following tabs: Deal Relative Profile Comparison, Profile Distribution, Transition Matrix, Deal Performance Summary, and our new Roll Performance.

Take a look at the features below, or, better yet, click here to access Data Dynamics and see our new features in the tool. We look forward to your feedback. Our goal is to continuously enhance the tool to enable you to get the most out of it.

For questions, please contact the Fannie Mae Investor Help Line at 1-800-232-6643, Option 2 or via e-mail.