Fannie Mae announces new Extend Modification for Disaster Relief

Fannie Mae’s most recent Lender Letter LL-2017-09 provides more clarification on policies related to disaster relief, which includes additional details for servicers on how to evaluate borrowers for workout options after a disaster-related forbearance. In addition, the Lender Letter introduces the Fannie Mae Extend Modification for Disaster Relief, a new post-disaster forbearance modification developed jointly with Freddie Mac and the Federal Housing Finance Agency (FHFA).

The new Extend Modification for Disaster Relief results in a fixed-rate modification that extends the mortgage loan term in monthly increments to match the number of delinquent payments, not exceeding 12 months. This modification is designed for borrowers who were current or less than 31 days delinquent at the time of the disaster and meet the eligibility requirements as outlined in the Lender Letter. Servicers are encouraged to implement the Extend Modification for Disaster Relief immediately but must begin evaluating borrowers for this new modification program no later than February 1, 2018.

As part of the Lender Letter, Fannie Mae has established guidance to servicers to evaluate borrowers that are unable to become current on their mortgage loans after post-disaster forbearance relief and subsequently require a modification when the property securing the mortgage loan or the borrower’s place of employment is located in a FEMA Declared Disaster Area eligible for Individual Assistance. This guidance provides the hierarchy of modifications for which servicers must evaluate borrowers and the factors servicers should take into consideration in their evaluation. These factors include:

- Was the servicer able to establish a Quality Right Party Contact (QRPC)1 with the borrower during the disaster forbearance period?

- Can the borrower maintain current contractual principal, interest, taxes, and insurance?

- Can the borrower manage any additional escrow repayment obligation?

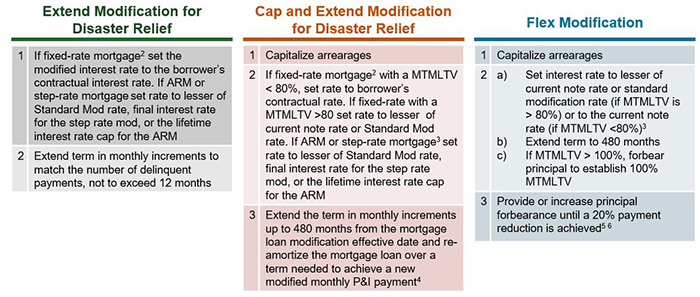

Upon reviewing the required factors, the servicer will work with the borrower to determine the appropriate post-disaster-related forbearance plan modification. The below chart illustrates the hierarchy of the modifications for consideration and describes the corresponding steps that are taken for each modification program that Fannie Mae makes available to those impacted by a disaster event.

For Connecticut Avenue Securities™ (CAS) transactions, the Extend Modification for Disaster Relief will not result in modification loss amounts being passed through to investors. Under our current policy, as with any other modification, a loan must be removed from the MBS trust before any permanent modification is completed. Full details on the Fannie Mae Extend Modification for Disaster Relief and additional details on policies related to disaster relief can be read here.

For questions, market participants may contact the Fannie Mae Fixed-Income Investor Helpline at 1-800-2FANNIE or by e-mail.

1 Quality Right Party Contact (QRPC) is a uniform standard for communicating with the borrower, co-borrower, or a trusted advisor (collectively referred to as "borrower") about resolution of the mortgage loan delinquency.

2 Includes adjustable-rate mortgages (ARMs) and step rate mortgages that are at their final note rate.

3 This logic applies to a fixed-rate mortgage, including adjustable-rate mortgages (ARMs) and step rate mortgages that are at their final note rate. For ARMs and step rate mortgages that have not reached their final note rate, those mortgages are converted to fixed-rate mortgages and the note rate is then set to the lesser of the standard modification rate or the lifetime cap (in the case of an ARM loan) or the maximum step rate (in the case of a step rate mortgage loan).

4 The new modified monthly principal and interest payment must be as close to the current pre-modification principal and interest rate as possible without exceeding the pre-modification principal and interest payment.

5 The servicer must not forbear more than an amount that would create a post modification MTMLTV ratio less than 80% using the interest bearing PB or 30% of the gross post modification UPB of the mortgage loan.

6 In the case of a borrower that is 89 days or less delinquent and who submitted a complete BRP, principal forbearance is increased until there is a minimum 20% payment reduction and a Housing expense-to-income (HTI) ratio of 40% is achieved. See Fannie Mae Servicing Guide D2-3.2-12, Fannie Mae Flex Modification for a detailed explanation of the HTI calculation.