Multifamily Connecticut Avenue Securities

Multifamily Connecticut Avenue Securities (MCAS) is an additional credit risk transfer vehicle that further supports our focus on capital management.

In 2019, Multifamily introduced its second back-end credit risk transfer vehicle, Multifamily Connecticut Avenue Securities® (MCAS™), which complements the MCIRT™ and the DUS® loss-sharing program.

MCAS allows us to reach a broader and more diverse investor base, which creates a more liquid and stable market for multifamily credit risk.

Building out our back-end credit risk transfer capabilities gives Multifamily the tools to manage capital requirements effectively, enabling a resilient business that provides a strong return on capital.

$75.5B of unpaid principal balance was covered through MCAS transactions, measured at the time of the transactions, as of Q3 2025.

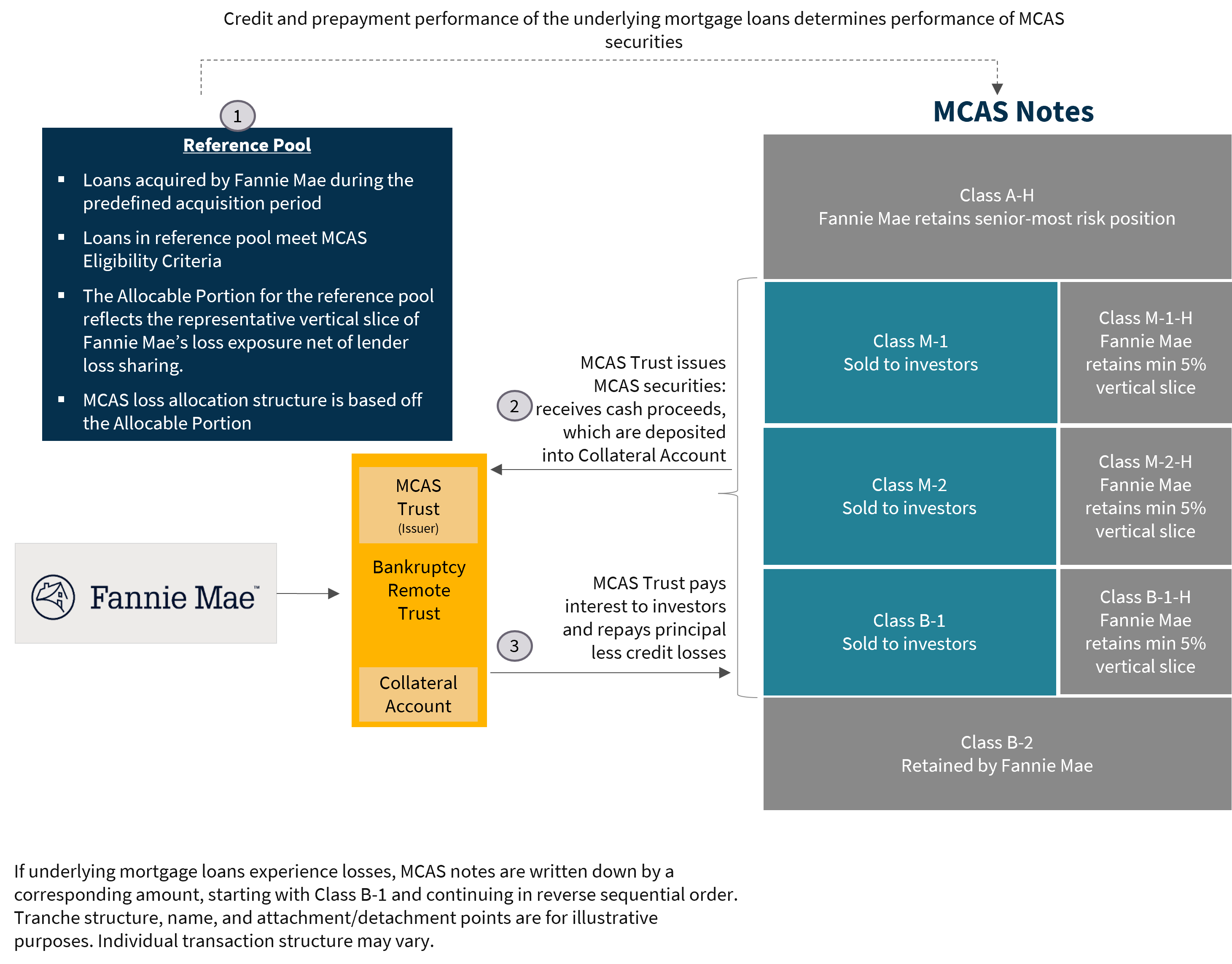

Illustrative MCAS deal structure

Click image above for larger view

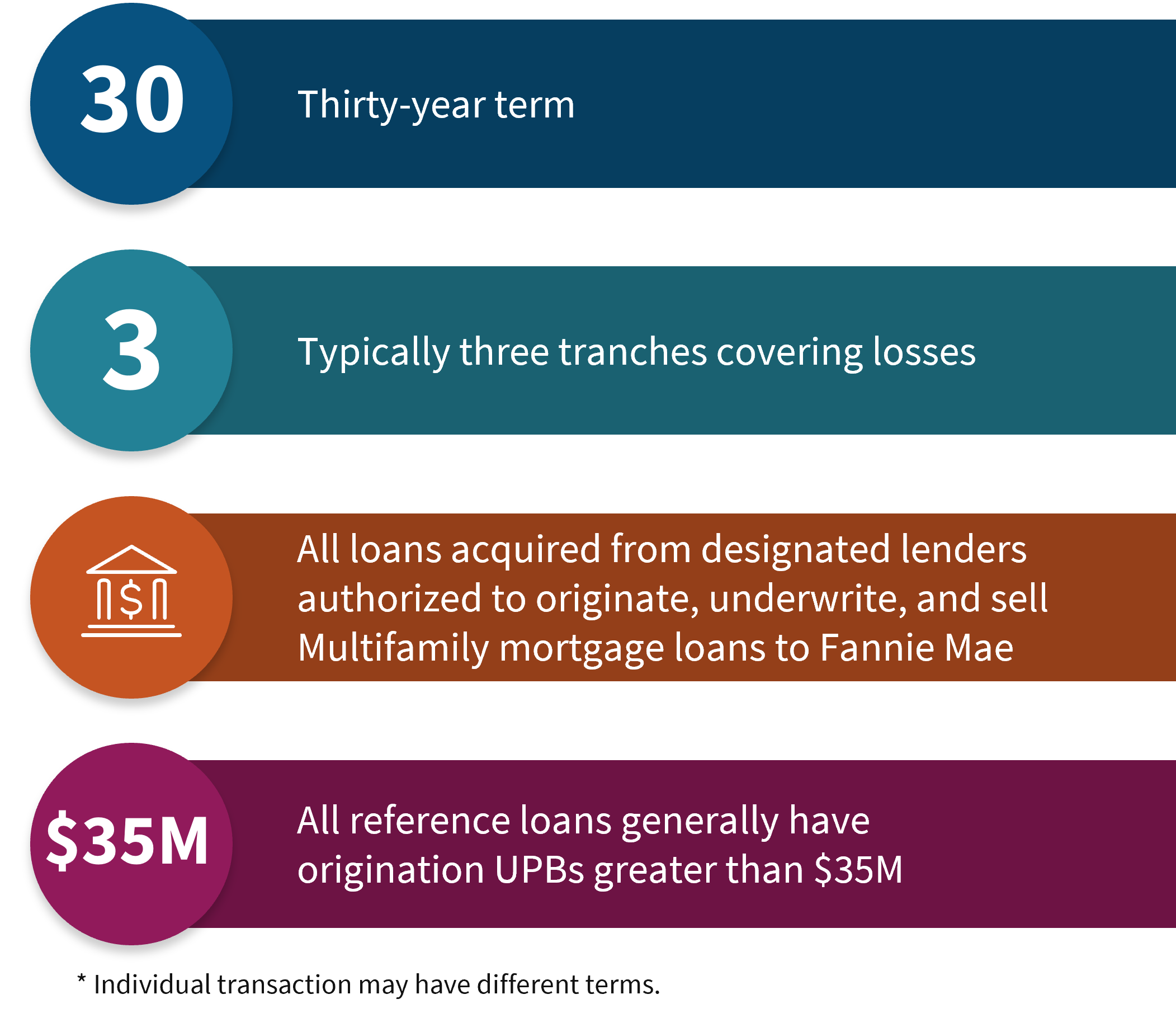

Elements of a typical MCAS deal*

Learn More

Are you an institutional investor who wants to learn more about our MCAS program? Contact us here.